One Person Company Registration

Want to know More ?

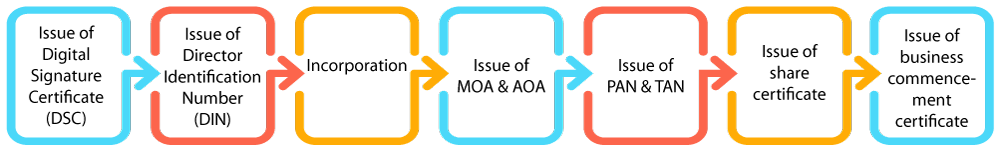

One Person Company Registration Deliverables

Basic Requirements For One Person Company Registration

- Only one person as a member / Shareholder.

- One nominee for the Shareholder.

- DSC (Digital Signature Certificate)

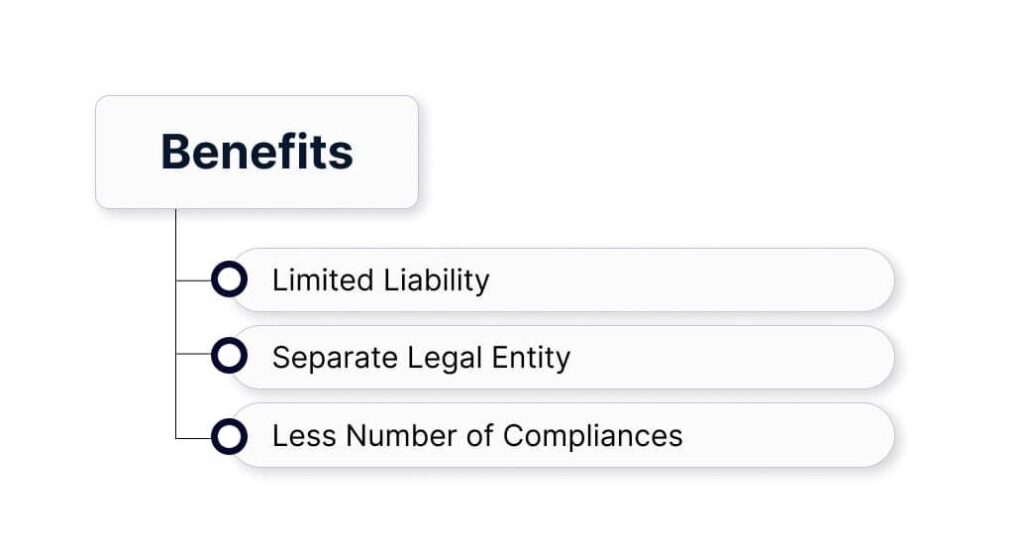

Benefits of a One Person Company registration

After the online registration of a One Person Company in India, there are the following benefits that can be enjoyed:

Limited Liability

As the business entity is a company, the entrepreneurs have their assets protected from the failings of the company.

Separate Legal Entity

An OPC Company is a separate legal entity from the owner.

Less Number of Compliances

For a One Person Company, the number of compliances is less.

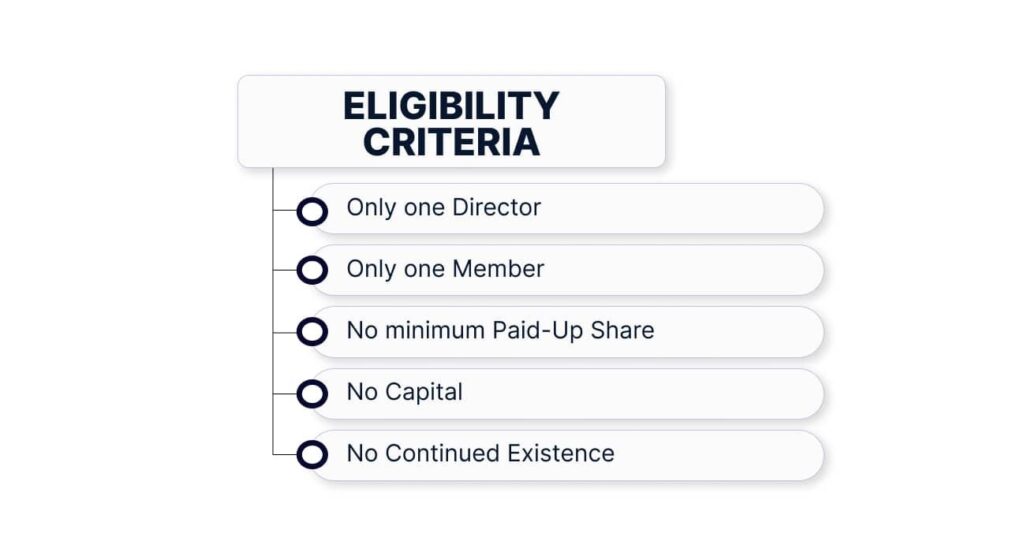

Eligibility Criteria for One Person Company Registration in India

Before you can register OPC (One Person Company), there are some requirements that you need to keep an eye out for. Following are the OPC registration requirements that you need to know:

- Only one director

- Only one member

- No minimum paid-up share

- No capital

- No continued existence allowed

These minimal requirements make the OPC business registration process quite accessible yet still difficult for common people.

Advantages Of OPC Registration

Registering One Person Company gives you the following benefits:

- A separate legal entity

- Raising funds for an OPC is easy.

- More opportunities, limited liability

- Minimum Compliances

- The only owner

- Its Identity is distinct from that of its owners

- Gives your business a social recognition and a legal structure.

- No loss of personal assets.

- The financial statements of OPC need not include cash flow statements.

- A company secretary is not required to sign the annual returns.

- Several provisions relating to meetings and quorum do not apply to OPC.

Types Of OPC Companies

An OPC company shall have a minimum paid-up capital of 1 Lakh and there will be a restriction in the transfer of their shares. Also, it prohibits for Inviting the public to subscribe to the issue of shares in the company

OPC limited by guarantee and having a share capital –

An OPC limited by guarantee with share capital usually has the shareholders who act as guarantors and the liability of the members is limited. The guarantors contribute a nominal amount (typically very small) in the event of the winding-up of the company.

OPC limited by guarantee and having no share capital –

An OPC limited by guarantee without share capital does not usually have shareholders, but instead has members who act as guarantors.

OPC unlimited having share capital –

An unlimited OPC is a hybrid company incorporated with or without a share capital but where the legal liability of the members or shareholders is not limited.

OPC unlimited not having a share capital –

The liability of the members is limited to the amount unpaid, if any, on the shares held by them. The share capital of the company is divided into a number of shares. Unlimited Company not having Share Capital. The liability of the members is unlimited.

ABOUT US

ComplianceKart is a professionally managed company to provide virtual compliance support to startups and business. Our main agenda is to avoid the non-compliance cost and provide with quality services virtually.

FOLLOW US

Privacy Policy | Terms & Conditions | Cookies © 2022 All rights reserved.