Microfinance Company Registration

A Microfinance services are basically targeted on individuals who do not have enough access to banking and other related services. These banking services are basically given to un-employed individuals and individuals who draw a low income.Majority of these micro financing occurs in developing nations. These microfinances promote economic development and help the poor to manage their finances effectively.

Want to know More ?

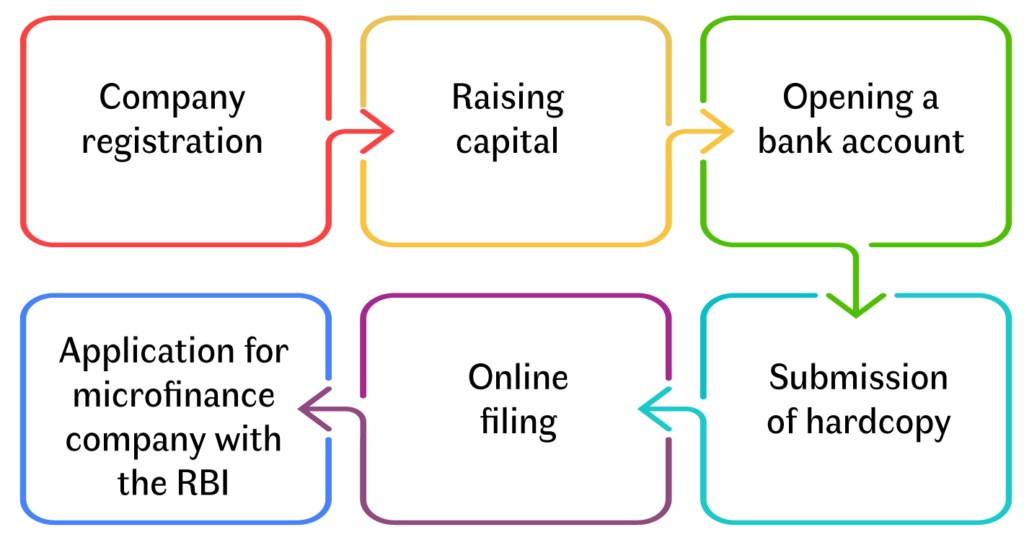

Procedure For Microfinance Company Registration

Top-Standard Services From Compliancekart

Procedure For Microfinance Company Registration In India

The first step in a Microfinance company registration is to register a company either as Private Limited Company or Public Limited Company as per Companies Act, 2013. Initially, a capital of Rs 1,00,000 is required.

Raise Capital

Raising authorized and paid-up share capital up to Rs. 5 Crore or Rs. 2 Crore is the next step. This capital needs to be shared in the form of equity Share Capital and not Preference Share Capital.

Bank Account Opening

After Incorporation Of The Company, the amount received is deposited in a bank account through a Fixed Deposit. A certificate of no lien shall be then obtained from the bank. This certificate shall be attached with an application which will be submitted with the RBI.

Application for Microfinance Company Registration with RBI

The next step is to submit the following documents for registration of the microfinance company with the RBI

1.Copy of Certificate of Incorporation

2.Copy of an extract of the main object clause in MOA.

3.Copy of fixed deposit receipt.

4.Bankers Certificate of no lien in relation to Net Owned Fund

5.Bankers Report

File Online Application

An online application will be filed with the RBI for after filing as an online application with the RBI for Microfinance Company Registration, the company will get a Company Application Reference Number.

Hard Copy Submission

After the filing of the online application, a hard copy of the application along with the necessary documents will be submitted to the regional office of the Reserve Bank of India. A certificate of will be issued by the RBI on receiving the application and conducting due diligence and after satisfaction.

ABOUT US

ComplianceKart is a professionally managed company to provide virtual compliance support to startups and business. Our main agenda is to avoid the non-compliance cost and provide with quality services virtually.

FOLLOW US

Privacy Policy | Terms & Conditions | Cookies © 2022 All rights reserved.