Nidhi Company Registration In India

Want to know More ?

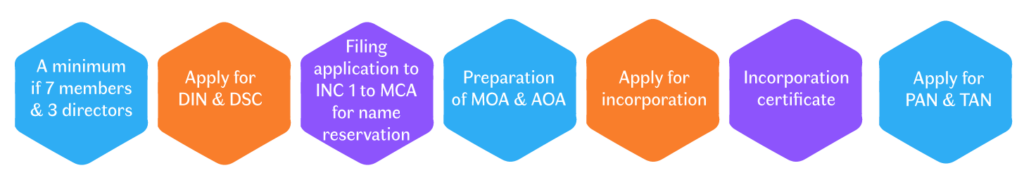

Process Of Registration Of Nidhi Company

High-End Services Rendered At Compliancekart

The expert professionals at Compliancekart will surely render the right Business Services that you’re looking for. Your NCR can be registered with ease when you choose to work with the professionals at Compliancekart corporate solutions.

We at Compliancekart will render the best services and you’ll surely love the end result.

Nidhi Company Registration Requirement

A minimum paid-up share capital of Rs five lakh is required to register a Nidhi company. The name of the company must end with Nidhi Limited.

Directors

There should be a minimum of 3 directors. The minimum age of the directors must be18+ Years. Family members are also eligible to join as directors.

Shareholders

Minimum 7 Share shareholders are required. Directors are also allowed to own shares in Nidhi Company.

No Minimum Shareholdings

If you want to keep maximum control over the business you’re allowed to retain even 99.99% shares.

No Finance Experience Required

You are still eligible for Nidhi company License even if you do not have any experience with NBFC , bank or Nidhi

Nidhi Company Registration in India

Nidhi Company is a business entity in India governed under the Companies Act 2013. Its sole objective is to engage with thrift and savings among its members. A Nidhi Company is a Non-Banking Financial Institute that exclusively provides services like lending and deposits to its members. Therefore, it can be said a Nidhi Company in India only consists of funding from its members and shareholders.

Starting a Nidhi Company in India means starting a Non-Banking Financial Companies class. They are governed by the Reserve Bank of India. This body tells the registered Nidhi Company guidelines about lending and depositing activities. However, Nidhi Companies can only deal with their members. Therefore outside members are not allowed.

Why should you register a Nidhi Company?

Nidhi Company is one of the business entities that enjoy several company perks. The following are those perks that make Nidhi Company Registration quite a beneficial affair:

Easy Access to Loans

Nidhi Company is a recognized infrastructure by the Central Government. It is trusted more by the banks. Therefore, once you register a Nidhi Company, acquiring loans and other types of findings is easy

Continued Existence

A Nidhi Company enjoys a continued existence even after one of the directors is deceased.

Easy to Incorporate

The Incorporation of a Nidhi Company is quite easy. It follows the standard procedure of Company Registration in India.

Separate Legal Identity

After forming a Nidhi Company, it becomes a separate legal identity in India. It can be said that a Nidhi Company becomes a separate individual who shall be able to own a property, invest, etc.

Limited Liability

A Nidhi Company enjoys limited liability for its members. This means that in the event of loss, the members of the Nidhi Company won’t have their assets harmed.

Nidhi Regulations regarding Deposits

A registered Nidhi can accept deposits for a minimum of six months and a maximum of sixty months. A Nidhi can accept recurring deposits for a minimum of twelve months and a maximum of sixty months. But the maximum balance in a savings deposit account at any given time must not exceed one lakh rupees.In addition, the interest rate must not exceed two per cent above the interest rate payable on the savings bank account by nationalized banks. A Nidhi must offer interest on fixed and recurring deposits at a rate not exceeding the maximum interest rate prescribed by the Reserve Bank of India. It must also foreclose a fixed deposit account or a recurring deposit account of a depositor subject to the following conditions:

- A Nidhi must not repay any deposit within three months from its acceptance.

- A Nidhi, at the depositor’s request, must repay any deposit after three months. Furthermore, the depositor must not be entitled to any interest up to six months from the date of deposit.

- At the depositor’s request, a Nidhi must repay a deposit before the expiry of the period for which Nidhi accepted the such deposit. In addition, the rate of interest payable by Nidhi on such a deposit must be reduced by two per cent from the rate Nidhi would have ordinarily paid.

ABOUT US

ComplianceKart is a professionally managed company to provide virtual compliance support to startups and business. Our main agenda is to avoid the non-compliance cost and provide with quality services virtually.

FOLLOW US

Privacy Policy | Terms & Conditions | Cookies © 2022 All rights reserved.